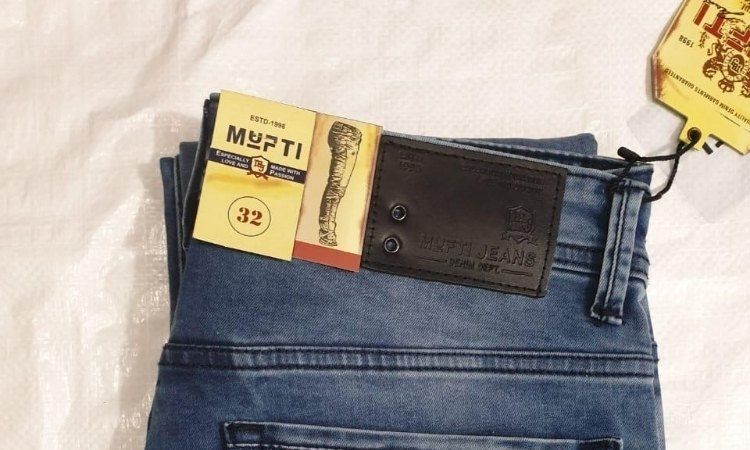

Credo Brands Marketing Ltd, renowned for its highly sought-after Mufti jeans brand has recently lodged preliminary documents for an initial public offering (IPO) in India. This proposed IPO entails a complete offer for sale by current shareholders and promoters. Noteworthy is the fact that the company commands a substantial market share in the men’s casual wear sector and boasts an extensive network of 1,773 touchpoints nationwide.

Credo Brands Marketing Ltd, the manufacturer of the renowned Mufti jeans brand, has recently lodged preliminary documents with the Securities and Exchange Board of India (SEBI) for the purpose of raising capital through an initial public offering (IPO).

This offering is an unadulterated sale of up to a staggering 19.63 million shares by its existing shareholders and esteemed promoters. The Offer for Sale (OFS) encompasses a remarkable 4.14 million shares by Kamal Khushlani, an impressive 4.28 million shares by the esteemed Poonam Khushlani, an admirable 2.03 million shares by Concept Communications Ltd, 5.03 million shares by Bela Properties Pvt Ltd, 1.97 million shares each by Jay Milan Mehta and Sagar Milan Mehta, and 0.11 million shares by Andrew Khushlani.

Dam Capital Advisors, ICICI Securities, and Keynote Financial Services Ltd have taken up the mantle of lead managers.

Being a player in the domain of men’s casual wear, Credo Brands Marketing Ltd specializes in the mid-premium and premium segments.

As of May 31, 2023, this indomitable company boasts an extensive pan-Indian presence, with an astounding 1,773. These touchpoints are an amalgamation of 379 Exclusive Brand Outlets (EBOs), 89 Large Format Stores (LFSs), and 1,305 Multi-Brand Outlets (MBOs), catering to customers across diverse locales, spanning from metropolises to Tier-3 cities.

For the fiscal year of 2023, the company unveiled a revenue figure of Rs 498.18 crore, eclipsing the previous year’s figure of Rs 341.17 crore. The net profit was of Rs 77.51 crore, a substantial leap from the previous year’s Rs 35.74 crore. Not to be outdone, the company’s EBITDA margin was 32.89 percent, leaving its previous figure of 27.87 percent in its wake. The company’s net debt for the period stands at Rs 183.78 crore, dwarfing the Rs 103.59 crore from a year prior; This includes lease liabilities as well.