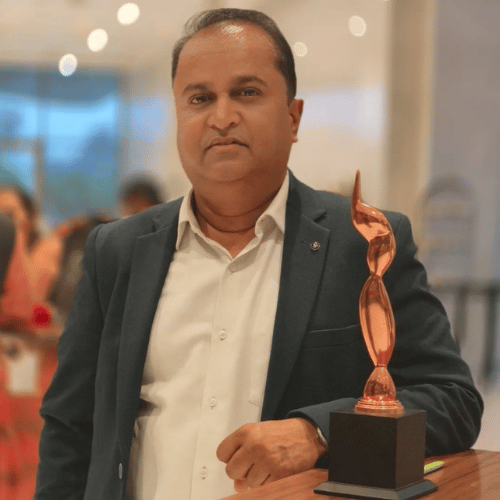

Adil Agarwal, the CEO, with a vision at the helm of Dr. Agarwals Health Care, is leading efforts to achieve growth. The goal is to increase their number of hospitals to 300 by 2025. Thanks to a funding boost of $80 million, from investors Temasek and TPG Agarwals mission to deliver top-notch eye care services is now expanding across both India and Africa. As a result, they are actively shaping the healthcare landscape in these regions.

On Thursday, Dr. Agarwal’s Health Care announced a successful capital infusion of $80 million from its existing investors, Temasek from Singapore and TPG based in the United States. The purpose behind this financial boost is to facilitate the ambitious expansion plans of this Indian eye hospital operator, as it sets its sights on doubling its current count of hospitals.

The foremost shareholder of publicly listed Dr. Agarwal’s Eye Hospitals is fervently working towards an impressive target – operating a network of 300 hospitals by the culmination of 2025. Presently, the company oversees a substantial array of over 150 hospitals, extending its reach even to African nations such as Nigeria and Kenya.

As this strategic move was announced, the company’s shares surged by an impressive 10.3%, subsequently settling for a notable 5.1% gain.

In terms of fiscal projections, the company is optimistically envisioning a revenue of approximately 15 billion rupees for the ongoing financial year, with aspirations to escalate this figure to an impressive 25 billion rupees within the ensuing three years. This vision was articulated by none other than the CEO himself, Adil Agarwal.

The drive for expansion is further underlined by Dr. Agarwal’s commitment to invest a substantial sum of over 12 billion rupees (equivalent to $144.45 million) in the establishment of new hospitals across India. Not stopping there, they are also planning to establish 10 centers across the African countries of Kenya, Zambia, and Tanzania. This strategic blueprint was officially communicated via a comprehensive press release.

It’s noteworthy that this funding achievement arrives on the heels of a preceding funding round that took place a little over a year ago. Founded in 1957 in the southern Indian city of Chennai, Dr. Agarwal’s managed to secure an investment of 10.50 billion rupees from its stalwart supporters, Temasek and TPG Growth – a subsidiary of TPG focused on the middle market.

This push towards private healthcare is a direct response to the burgeoning demand within India, fueled by both a burgeoning and aging population as well as an increase in disposable income levels.

The recent pandemic has further accentuated the public’s consciousness of health and well-being, making private healthcare an even more appealing proposition.

This trend has not gone unnoticed by global investors who are keenly observing India’s private healthcare market, which is estimated to be valued at around $48 billion. A case in point is Temasek, which made a substantial investment of $2 billion in April to significantly raise its stake in the multi-specialty chain, Manipal Hospitals, thereby increasing its ownership from 41% to an impressive 59%.