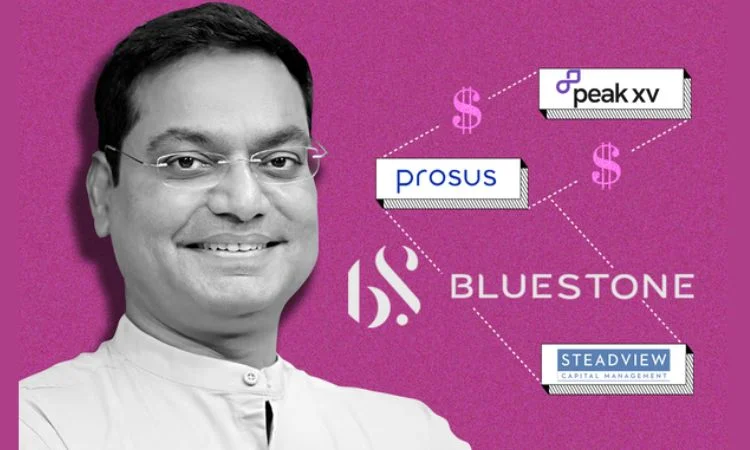

Bluestone is a well-recognized omnichannel jewelry retailer with a wide product range that caters to both the men’s and women’s segments. The company has successfully closed its latest funding round with Rs 600 crore, or approximately $72 million, backed by key investors. Funding was led by Prosus through its subsidiary, MIH Investments, followed by participation from key investors such as Steadview, Think Investments, and Pratithi Growth Fund, in another vote of confidence in the business model and market growth prospects of Bluestone.

PC: The Economic Times

Copies of internal filings accessed by Entrackr from the Registrar of Companies show that the board of Bluestone approved the issue of 1,03,80,622 Series H compulsory cumulative preference shares at an issue price of Rs 578 each to raise the mentioned significant funding of Rs 600 crore. While Prosus was the lead investor in this funding round with Rs 351 crore, Steadview Capital invested Rs 80 crore, Think Investments Rs 84 crore, and Pratithi Growth Fund Rs 35 crore. Overall, the funding round also witnessed the participation of 27 other investors-a fact that underlines strong investor interest in Bluestone’s growth trajectory.

The funding round forms part of the Rs 900 crore pre-IPO round reported earlier wherein a significant portion of the capital raised was reported to be carved out for secondary transactions. The capital raised by way of this investment would be utilised to finance strategic initiatives of the company intended at expansion, ongoing operations and capital expenditure apart from general corporate purposes, positioning Bluestone for continued growth and market leadership in the competitive jewellery retail landscape.

Per TheKredible, a startup data intelligence platform, Bluestone now commands a post-allotment valuation of around $972 million, reflecting its value proposition in the rapidly evolving retail landscape.

Prosus owns 4.48% in Bluestone, while Steadview Capital, Think Investments, and Pratithi Growth Fund own 1.04%, 1.10%, and 1.08%, respectively, of the company, underlining the diversified investor base for Bluestone’s growth journey.

Founded by visionary entrepreneur Gaurav Singh Kushwaha in 2011, Bluestone has steadily gained a reputation as one of the finest jewelry destinations for customers seeking variety and convenience through its online channel, reaching across the country via offline stores. Having expanded its network to more than 190 stores in about 75 cities, Bluestone still continues to revolutionize the world of jewelry retail with strong attention to detail in craftsmanship, innovative design, and personal service.

Undoubtedly, the market dynamics remain harsh, but for the fiscal ending in March 2023, Bluestone demonstrated resilience in growth momentum, achieving an incredible 65% YoY revenue growth with a collection value of Rs 787 crore. It has also achieved sizeable improvements in the use of resources, as reflected in an 87% reduction in its losses to Rs 167 crore. As Bluestone gears up to declare its annual result for FY24, the company is going ahead with sustainable growth initiatives regarding customer engagement and market outreach.

In a competitive landscape, the immediate competitor of Bluestone, CaratLane-a subsidiary of Titan-registered robust financial performance on revenues at Rs 3,081 crore and a profit of Rs 79 crore in FY24, which underlined the dynamism and promise that characterized the jewellery retail market in India.

This new round of funding propels Bluestone into an orbit of faster growth, increased innovation, and extension into newer markets, thus better equipping it to avail full advantages of emergent opportunities, create better brand presence, and added value to customers on all counts when presenting their range of beautiful jewelry.