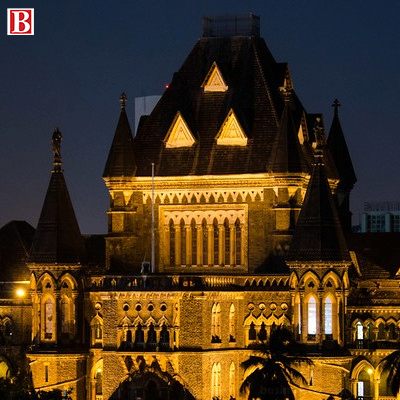

Promoters of the company, Adisri Commercial Private Limited asked for the stay on any insolvency proceedings against the two companies on October 6, 2021 by filing a writ petition in Bombay High Court.

Bombay High Court reportedly on October 7, 2021, dismissed Kolkata-based Srei Group’s petition filed against RBI (Reserve Bank of India) which recently took action on the subsidiaries of the company namely- Srei Infrastructure Finance Limited (SIFL) and Srei Equipment Finance Limited (SEFL).

Promoters of the company, Adisri Commercial Private Limited asked for the stay on any insolvency proceedings against the two companies on October 6, 2021 by filing a writ petition in Bombay High Court. Adisri is the holding corporation of Srei which holds over 60. 36 per cent stake in its subsidiary Srei Infrastructure Finance Limited.

As reported by Moneycontrol, the High Court did not disclose reasons, but said it would give the reasons later. A person familiar with the update said that post considering the reasons, the Srei Group would further decide the action to be taken in future.

The RBI declared to take control over the boards of Srei Infrastructure and Srei Equipment due to defaults by Srei Group-owned companies. As a recent update, RBI also named the former CGM (Chief General Manager) at Bank of Baroda, Rajneesh Sharma as new administrator.

The RBI’s move against the company triggered Srei Group to take legal action which led to the Bombay High Court. On being accused of defaults, the company shared that the banks were appropriating funds on a regular basis from the escrow account which were under their control since November 2020. Srei Group added that the banks never communicated about any defaults on the company’s behalf.

It was observed that the RBI stepped forward to take over the board of Srei Group after the creditors of the latter dishonored the proposal put forward by the management to give a one-year standstill, legally or otherwise, with the view of working on dues calculated at Rs. 30,000 crore.

Srei Group disclosed earlier about the proposal it submitted to pay the banks under a scheme under Section 230 of the Companies Act 2013 in October, 2020. However, the banks did not respond as the company said that it neither approved nor rejected the proposal by the company. The company further shared on its defense that it has never stepped behind or delayed in loan servicing.

Srei Group has to pay over Rs. 30,000 to its creditors, out of which the company owes about Rs. 18,000 crore to banks and the remaining to other creditors.