Investment Firm Supports Echelon’s Vision for Capital-Efficient DeFi Solutions

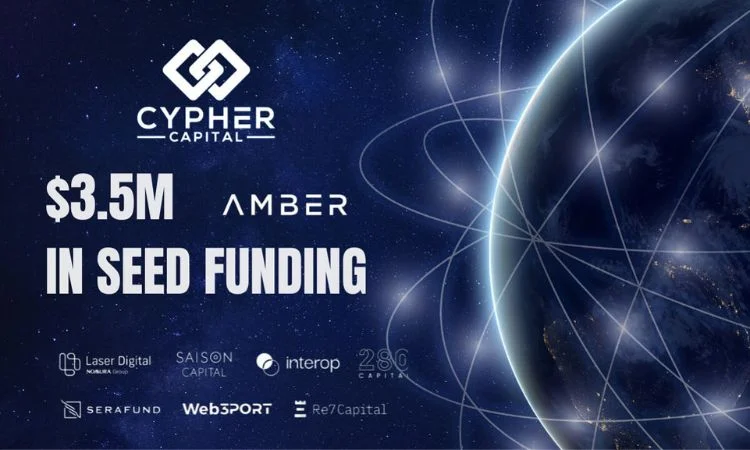

In a significant move within the decentralised finance (DeFi) space, Dubai-based Cypher Capital, a multi-strategy crypto investment firm, has announced its participation in a $3.5 million seed funding round for Echelon, a decentralised lending protocol. This funding round also saw contributions from several strategic partners, including Amber Group, Laser Digital, Saison Capital, Selini Capital, Interop Ventures, and Re7.

PC: FXEmpire

Commitment to DeFi Innovation

The investment underscores Cypher Capital’s dedication to advancing solutions within the DeFi ecosystem and broader blockchain technology. Echelon is poised to revolutionise DeFi lending by improving capital efficiency, integrating with other DeFi applications, and offering innovative yield strategies on Move-based blockchains such as Movement and Aptos.

Harsh Agarwal, Investment Lead at Cypher Capital, highlighted the firm’s excitement about Echelon’s potential. “Echelon has demonstrated that their project is truly driving innovation in the DeFi space. Their focus on capital efficiency, user-friendly design, and integration of real-world assets makes them a standout in the evolving DeFi landscape. We are excited to support their efforts in developing high-performance lending markets,” Agarwal said.

Echelon’s Advanced Protocol Features

Echelon’s platform brings several cutting-edge functionalities to the DeFi sector. The protocol increases borrowing power on correlated assets, offers isolated pools for niche asset markets, and facilitates direct in-wallet integration for seamless yield strategies. The design of the platform targets institutional-grade markets, aiming to deliver affordable borrowing rates alongside innovative yield opportunities.

Glen Rose, cofounder of Echelon, expressed enthusiasm about the new funding and the future of the platform. “This funding will help us build additional lending and risk management products, expand to new networks, and provide global access to dollar-denominated yields,” Rose stated. “We’re excited to build core primitives on high-performance Move-based chains.”

Future Plans and Development

With the newly secured funding, Echelon plans to expand its offerings and strengthen its market presence. The company intends to develop strategies backed by treasury and real-world assets (RWAs), implement cross-chain deposit vaults, and grow its team of full-stack and smart contract engineers. These initiatives will help Echelon scale its operations and continue to innovate within the DeFi space.

By targeting both retail and institutional investors, Echelon aims to provide a decentralised, efficient, and user-friendly lending platform that meets the needs of a diverse range of users.

About Cypher Capital

Cypher Capital is a prominent early-strategy venture firm that focuses on investments in Web3 infrastructure and applications. The firm is committed to shaping the future of the digital economy by investing in projects that align with environmental, social, and governance (ESG) principles. Cypher Capital’s portfolio spans across digital currency, public markets, and Web3 applications, with a mission to drive the next generation of digital innovation.

About Echelon

Echelon is a high-efficiency decentralised lending protocol that allows users to borrow and lend assets through non-custodial pools. The platform enhances capital efficiency and borrowing power while ensuring secure, overcollateralized positions. Echelon supports isolated pools for long-tail assets and provides streamlined leverage staking and RWA-backed vaults, positioning itself as a leader in the next generation of DeFi protocols.

This seed funding marks a pivotal moment for Echelon as it continues to build and refine its platform, paving the way for the future of decentralised finance.