The retail market of India is a dynamic one with well established players. However, an entrant has transgressed the industry norm with a wave of consumer affinity. DealShare, an e-commerce company which is now fast expanding, has seen its unique way of doing business, designed with the Indian customer in mind – very particular and specific, according to their tastes – attracting more and more attention. This journey is not intended to just narrate the ups and downs of DealShare. But, in reality, it goes far beyond that because it tries to identify the characteristics that make DealShare achieve the outstanding success that it has had.

| Table Of Contents |

| Introduction |

| DealShare Success Story: Overview |

| DealShare Success Story: Company Highlights |

| DealShare Success Story: Concept Behind The Startup |

| DealShare Success Story: The Business Model |

| DealShare Success Story: Revenue Model |

| DealShare: Supply Chain Optimization and Business-to-Consumer Marketing |

| DealShare: Funding |

| Leveraging Innovative Marketing Strategy: Exploration of DealShare’s Journey to Unicorn Status |

| DealShare: Top Competitors |

| DealShare: Future Plans |

| DealsShare: Challenges Faced |

| Conclusion |

DealShare Success Story : Overview

Source: Dutch uncles

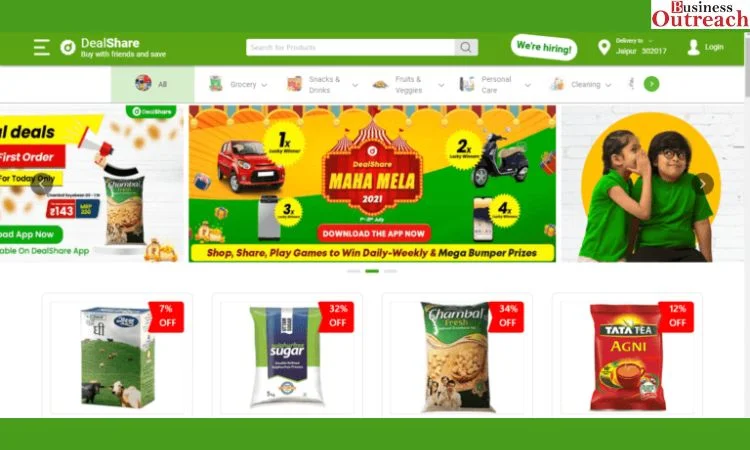

DealShare is an Indian e- commerce platform built on the business foundation of social e-commerce. The space occupation was founded in 2018 by Vineet Rao, Sourjyendu Medda, Sankar Bora and Rajat Shikhar. The Naia headquarters is located in Jaipur, Rajasthan.

DealShare works in group buying and community-based sales. Its platform allows buyers to get many goods at cheaper prices by sharing deals with friends and relatives. From foods to personal care, household goods to clothing and fashion, our product range is huge.

Powered by mobile application DealShare, soon a network covering more than 150 cities of India became part of our family, among them Jaipur, Ahmedabad, Surat, Baroda, Kota, and Jodhpur. The company has a wide range of more than 1,000 local traders and a customers’ base of more than 20 million.

DealShare Success Story: Company Highlights

| Year Founded | Founders | Vision |

| 2018 | Vineet Rao, Sourjyendu Medda, Sankar Bora, Rajat Shikhar | Creating an e-commerce platform catering to the needs of the Indian middle class, a vast and underserved market. |

DealShare Success Story : Concept Behind The Startup

The foundation of Dealshare comes from the simple fact that although a noticeable segment of the population is still reluctant to purchase everyday goods including groceries, personal care items, and household essentials online, the market has been untapped. In the process of fighting with formidable competition, such as Amazon, Flipkart, BigBasket, and JioMart, the company has strategically utilized the social e-commerce avenue as one of its key success factors, helping to push its further growth curves up.

The marketing expenses for dealshare proved to be most efficient as the major client acquisition avenue was through user referrals and word of mouth. Nowadays, its footprint is sprawled all over just over one hundred cities covering ten US states. It is an inviting social network with a wide variety of users numbering 15 million registered people.

DealShare Success Story: The Business Model

Source: Dutch uncles

DealShare runs on a social commerce platform that is brought forth by the mobile application.

Product and Deal Offerings: The DealShare platform is designed to offer the widest possible selection of products in their inventory that are spread out over several categories like staple foods, personal care stuff, household items as well as fashion pieces.

They are obtained straight from the manufacturing companies and the distributors giving the platform an opportunity to sell them at the most favorable cost. Also, DealShare markets these products and applies an additional discount or deals, and then offers it to all users via the mobile app platform.

Community-Centric Selling: The focal component of DealShare’s operational model is a community driven selling method that enables consumers to share deals with their circle of most trusted people like friends and family, primarily over platforms such as WhatsApp and Facebook.

Group Purchase Dynamics: The platform allows the users to form virtual groups and give additional benefits to group buyers with more powerful discounts. By agreeing on joint procurement between an allowable number of users, a group is entitled to receive a reduced discount product price.

Delivery Services: Within that system, DealShare provides for a smoothened delivery of products ordered by users to their home addresses, thus bringing about even more universe of convenience and productivity in the shopping experience. However, the platform also entreats the multiple payment channels including Cash-on-delivery and digital transaction facilities.

DealShare Success Story : Revenue Model

DealShare derives revenue from various sources, encompassing the following primary streams:

Commission on Sales: DealShare on the top earns money on the basis of items sold via their platform. The principle behind the commission structure may be supported by factors that include product category, market volume, and other metrics.

Advertising Revenue: Streams of revenue are also constituted through advertising efforts during which brands and producers are actually paying to place their products on the platform. The direct result of this is the extraordinarily powerful nature of this source of income because of the big and the constantly growing customer base that DealShare possesses.

Subscription Services: It is welcoming the fact that this is a likely outlet for revenue generation using subscription-based services with extras for the users, a company for brands and manufacturers which might be realised at a later point .

Logistics Services: Revenue possibly can also come to the future by the way of logistics and fulfilment services to the brands and manufacturers. This addition helps to take advantage of the well developed distribution base of the platform by creating opportunities for a wider audience and ensuring simplification of operational processes.

DealShare : Supply chain optimization and business-to-consumer marketing at the lowest prices.

Fairly speaking, Dealshare’s goal in a childish language is to address the inequalities that emerge between manufacturers and consumers that are firmly held by its founders. Mr. Rao goes through the big picture plans which include perfecting the supply chain and bringing down the prices in the mass market in order to enable more people to purchase goods.

Source: CB Insight

Enshrining their unique offer is the remarkable mix of embracing low operational costs, precision in the selection of suitable goods, and market densification approach to cater the consumer`s common needs. This strategy underlines the effective management of both overhead expenditure on OpEx and CapEx concerning warehouse assortments besides deployment of a system of community leaders at the neighbourhood level correspondingly, which helps realize last mile costs—a core aspect of Dealshare Business philosophy.

Furthermore, marketing-wise the brand has adopted a budgeted tactic by means of platforms like Whatsapp to develop its customer network.

By providing customers with an avenue to become brand influencers while also supplying them with exclusive deals, the company has thus far experienced a heightened level of customer engagement. Mr. Rao however does not fail to highlight the importance of investing in machine learning and artificial intelligence and they aim to design their product using gamification. The aim of doing so is to improve customer engagements and to ultimately help with conversion rates.

DealShare: Funding

| Funding Round | Date | Amount Raised |

| Series A | July 2018 | $1 million |

| Series B | Sept 2019 | $11 million |

| Series C | Sept 2020 | $21 million |

| Series D | June 2021 | $144 million |

| Series E | Jan 2022 | Up to $130 million |

Since 2018- when the startup was incorporated, DealShare has managed to raise several rounds of funding, signifying confidence from investors and steady growth.

The breakdown of these funding rounds is as follows:

Series A Funding: The company’s deal share managed to top off their series A fundings worth a single million in July 2018, with primary investor 1Crowd and others with the angel investors.

Series B Funding: In September 2019, DealShare achieved a successful Series B fundraising round, led by none other than Matrix Partners India and Falcon Edge Capital with a total amount of $11 million. Omidyar Network India and other investors also joined the pool of investments in the same round.

Series C Funding: September, 2020 was the month when a fabric of dealshare’s $21 million was put together in series C fund, the sole investor WestBridge Capital was behind it. This round included inviting original investors like Matrix Partners India, and the Omidyar Network India as well.

Series D Funding: In June 2021, DealShare gained great success in which they raised 144 Million through a Series D fundraising round which was led by Tiger Global Management. In addition to these, WestBridge Capital along with other renowned venture capitalists from Matrix Partners India and Omidyar Network India were the existing investors who happened to make this round easier to manage.

Series E Funding: In the month of January 2022 DealShare achieved another of its milestones by collecting the amount could be up to $130 million in Series E funding round. This round was spearheaded by Tiger Global Management and Alpha Wave Global (a strategy run by Falcon Edge Capital) which were accompanied by further investments from the existing investors like WestBridge Capital, Matrix Partners India, Omidyar Network India among others.

The collective success of these funding rounds has pushed DealShare to the $1.6 billion valuation and has landed it into the elusive Unicorn club.

DealShare achieved $400 million in funding in its entire history thereby funding its expansion and helping it to make further operational improvements in India. The company can capture much attention by the well-known investors which imply that it is on the point of becoming a social commerce frontrunner.

Leveraging Innovative Marketing Strategy: Exploration of DealShare’s Journey to Unicorn Status

The ascent of DealShare to the “unicorn” status can rightly be viewed as the proof of their excellent application of groundbreaking marketing tactics.

Here Below an exploration of the pivotal methodologies adopted by this thriving E-Grocer firm:

Micro-Localization Strategy: Micro-localization approach, introduced by DealShare, has significantly contributed to its outcome as a success. Through carefully selecting the specific geographical areas for the business, the company has the luxury to customize plenty of products suited for the local taste, together with creative pricing options.

User-Centric Mobile Application: One of the key elements of the marketing tool set of DealShare’s promotional campaigns is the interactive mobile application, focussed on providing customers with an efficient purchasing procedure. Conveniently embedded in the emphasis on their specific approach, the app strengthens audience involvement as well as brand loyalty.

Incentivized User Acquisition: Acquisition of customers plays a very crucial role in a growth trajectory of DealShare and its drive for the users, while providing a monetary incentive. By tying in existing users to the product through maintaining a community-driven expansion model involving word of mouth and referrals, the company has established an innovation canvas, consequently growing at exponential rates.

DealShare : Top competitors

| Competitor | Description |

| Meesho | E-commerce platform enabling small businesses to sell products online. |

| SimSim | Social commerce platform connecting buyers and sellers through chat. |

| Mall91 | Social commerce app facilitating buying and selling within communities. |

| GlowRoad | Online platform for reselling products and earning commissions. |

| Bulbul | Social commerce platform focusing on live commerce and video shopping. |

DealShare: Future Plans

DealShare is an e-commerce platform, which particularly serves local brands and businesses. The philosophy of the company is to extend its services till the tier-2, tier-3 cities and hinterland thus providing to its customers the same quality of good products at fair prices.

Called out by its own demand generation strategy for which partnering with SMEs, efficient warehousing and logistics stand at the top, DealShare combats its rivals on the cutthroat market.

Telling the story of its own destiny, DealShare has come out with the main objectives for this year – that are the key events in this year. These can be developed and managed by creating additional manufacturing plants, recruitment of more jobseekers, and investing in new technology to increase efficiency and customer satisfaction.

DealShare : Challenges Faced

DealShare was faced with a number of challenges such as adapting their product offerings to market demand. This was later reflected in a change of leadership. Vineet Rao, the CEO of the company and also its co-founder, has vacated his role and therefore a new individual has been chosen to replace him as the head of the company.

Strategy transformation may be considered as the core statement for DealShare, and it is based on the company’s continuation as a D2C startup model, unravelling itself from its group buying platform model. Its target market is predominantly a low-income consumer segment. Food, general merchandise, and fashion items are the most common products in the organization’s product lines.

Conclusion

Finally, the retail market stories in India of DealShare have been so fantastic that they can’t be told in words. In face of market leaders, DealShare has redesigned the e-commerce landscape, targeting opportune lucrative areas which morning consumer audiences prefer, by a margin. The dealership manages to leverage social e-commerce, community-based sales, and group buying dynamics and that’s how on a quick count over 150 cities accomplished by them and now they have a customer base of above 20 million.