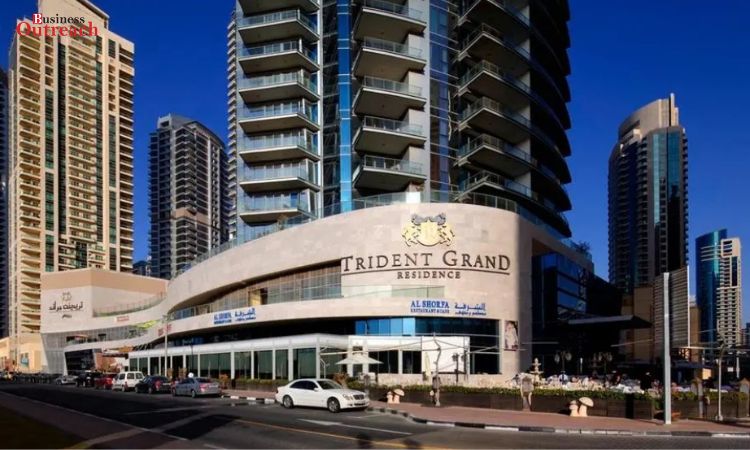

Dubai’s Equitativa, the largest REIT manager in the Gulf region, announced that its subsidiary Emirates REIT had sold Trident Grand Mall, located in Jumeirah Beach Residence, Dubai Marina. This underscores Emirates REIT’s commitment to improved efficiency in its portfolio and delivering value to stakeholders.

PC: Emirates REIT

Property Overview

Trident Grand Mall, acquired in 2014, is one of the most prominent two-floor retail components comprising 22 retail units and 164 basement parking bays. Over time, Emirates REIT has conducted extensive renovation work and enhanced the tenant mix to improve the marketability of the property and its prospects for income generation.

Details of the Sale

The transaction, which closed on July 18, ended with a final purchase price of AED 74 million ($20 million) against the latest valuation of the asset. This valuation reflects enormous market demand for well-positioned real estate assets in the highly competitive Dubai market.

Utilisation of Sale Proceeds

Emirates REIT proposes to use the net sale proceeds to redeem part of the secured Sukuk certificates issued in December 2022. The strategic placing is in line with the Company’s continuous efforts to optimise financing costs and enhance financial flexibility.

Strategic View from the CEO

Equitativa’s chief executive, Thierry Delvaux, was happy with the way the deal had ended, pointing out that it would be beneficial to Emirates REIT stakeholders. As Delvaux said, this sale agreed with Emirates REIT’s wider strategy of portfolio performance optimization and creating value for investors.

Outlook for Future Portfolio

After divesting Trident Grand Mall, Emirates REIT now holds a portfolio of nine diverse and well-positioned properties in Dubai, with a net lettable area of 202,575 square metres. Such an approach with this streamlined portfolio is likely to enable Emirates REIT to leverage the real estate market in the region for further opportunities.

Market Response and Investor Sentiment

Industry analysts have hailed the transaction as an endorsement of Emirates REIT’s proactive asset management strategy and financial discipline. Indeed, reducing financing costs and enhancing the quality of the portfolio has a very attractive ring to investors searching for sustainable returns from the Gulf region’s real estate sector.

The sale by Emirates REIT of Trident Grand Mall is a gigantic step in operational efficiency and strategic realignment with market dynamics. Reinvesting the sale proceeds into debt reduction underlines Emirates REIT’s commitment to capital structure optimization for long-term value creation.

In conclusion, Emirates REIT continues to demonstrate leadership in the Gulf region’s REIT market by leveraging strategic divestments to strengthen its portfolio and deliver sustainable growth for stakeholders.