The intricacies of finance can be a matter of concern for any average person, when in need of liquid money. Banks or any financial institutions exist to help customers. But in return for their services, they need to earn their fair share of interest. If you go out in the market seeking for a personal loan, it can come at an interest rate between 25 to 40%, depending on the medium.

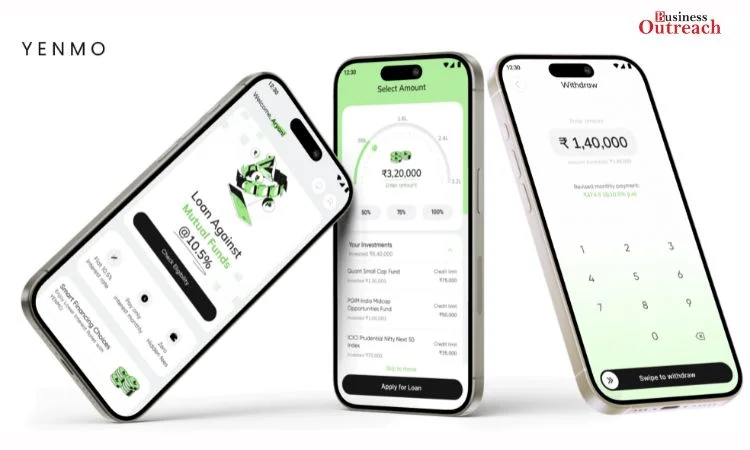

If you are an expert in maintaining a credit score, it could give a blow due to inquiry. But Yenmo comes with a solution for customers, where they would give an interest rate of about 10.5% for loans against mutual funds. Check out this space to learn more.

Yenmo was founded by Ashutosh Purohit and Aryan Agarwal. Ashutosh, Co-Founder and CEO, earlier worked at Navi, where he built the company’s mutual funds division from scratch, accumulating about Rs. 1,500 crore AUM. He also worked at Swiggy, as a pivotal part of the expansion team. Ashutosh Purohit studied at BITS Pilani, where he shares to have had the best times of his life.

He met with great peers and expresses the joy in creating something from the grounds and shaping that with technology and innovation is truly riveting. Aryan Agarwal, Co-Founder and CTO founded an algorithm-based capital management firm- Aryan Capital. Aryan previously worked at Browserstack for almost 2 years, where he was a software developer.

In his freelancing days, Aryan completed more than 11 projects, working mostly with esteemed clients from the US and Canada. Aryan Agarwal studied at BITS Goa, where he aced in several hackathons and successfully organized many events. Aryan has a deep knack for building apps and providing tech solutions.

Being the brainchild of Ashutosh and Aryan, Yenmo exceeded client expectations. Yenmo is offering loans against mutual funds at an interest rate of 10.5%. The process is completely digital and takes about 10 minutes. This is a secured lending financial product that comes with flexibility. Yenmo allows the customers to use only the amount they require and the interest will be charged on that amount.

It is interesting to understand that the customers can pay only the interest every month and the principal amount can be paid anytime within the loan period, without any foreclosure fee or additional charges. Since the customer is not selling their mutual funds investment, there shall not be any capital gains tax on equity funds or a tax based on income slab for debt funds.

Considering a case where a customer acquires a personal loan of Rs. 1 lakh for 3 years. At 25% interest rate, they would likely pay back about Rs. 1.43 lakh at an EMI rate of Rs. 3,976. With Yenmo, the customer can pay only the interest amount of Rs. 875 which is calculated at 10.5%.

At Yenmo, the interest will be calculated on the outstanding amount and not on the entire loan amount. For example, if you are eligible for a loan of Rs. 1 lakh, but if the outstanding amount is Rs. 50,000, then the interest is only payable to the Rs. 50,000 amount which is about Rs. 412 per month. Yenmo is offering the customer a seamless credit line facility.

Yenmo, under the leadership of Ashutosh and Aryan, got selected for YCombinator W24 batch. With support from the YC community, Yemno is scaling their business. Additionally, Yenmo is raising interest for several businesses, aiming for high ticket size products like travel & tourism, medical needs and many others. With the help of Yenmo’s tailored APIs, companies can integrate these services into their website in just two weeks.

Yenmo initiated their pilot program at an offline setup, where they got impressive results from the market. Upon gathering such data, Yenmo evolved into a digital setup that is growing at an enormous pace. In just 50 days of launch, Yenmo crossed more than 100 customers without spending on performance marketing. Yenmo has an average ticket size of about Rs. 2.5 lakh with an interest rate of 10.5%. Investments can be categorized as an emotional asset for an individual. Selling mutual funds would be detrimental to an investor’s long term goals for acquiring sustainable compounding rates.

Yenmo’s low interest rates on loans provides headroom for an investor to pay off the total amount with less stress in mind. Addressing the needs of the customers is the most pivotal aspect for Yenmo’s growth. The company has also collaborated with renowned NBFCs like Tata Capital and Bajaj Finserv to bolster customer retention and satisfaction. Yenmo shares that redemptions from mutual funds can only affect long-term goals of an investor. Opting for a loan against mutual funds with Yenmo shall allow the customer to avail an eligible loan along with keeping their dividends and any other benefits of the mutual fund.

A product succeeds when it is of any value to the end customer. Mr. Dinesh, Proprietor Parvat fashion says, “Yenmo has been a game-changer for my business! Their loan not only provided the capital I needed, but also came with an attractive interest rate of 10.5% compared to 17% to 19% interest on other loans in the market. And flexible terms like interest only payment was extremely beneficial for managing my finances.” Another testimonial is from Asheesh Mishra, who says, “It’s a wonderful app. Very smooth functioning. Support team is available on the phone and whatsapp. Loan against mutual funds was a new thing for me. Now I can recommend it, cause I have experienced it now, getting a loan on mobile is just a download away. Kudos for ‘Yenmo’.”

The fact that an individual’s credit score is not affected makes Yenmo a brilliant product. Lending has never been productive and efficient before Yenmo’s existence in the current market. One of the main objectives of Yenmo is to get B2B partnership leads, who are looking to add a credit option for their customers & improve their conversion.

When we asked Ashutosh on his take on success, he said, “I believe India is in the era of building companies that would be known and used by people across the globe. I’m eager to be in a world where people in some parts of the world would be trying to build Yenmo for their country.” Aryan added by saying, “I am confident that this product will become every investor’s first choice for meeting their immediate financial requirements, thanks to its convenience, speed, and flexibility.”