Accel and Lightrock India contributed $100 million to Niyo’s Series C investment, which closed in February. With the most recent round included, it has raised a total of $180 million.

Private equity firm Multiples Alternate Asset Management has raised $30 million for the consumer-focused financial platform Niyo.

Accel and Lightrock India contributed $100 million to Niyo’s Series C investment, which closed in February. With the most recent round included, it has raised a total of $180 million.

Through organic and inorganic prospects, the business will employ the capital to develop client base and enhance product capabilities.

As we strive to bolster our capacities to develop a highly useful consumer financial services platform, Bagri, who serves as the company’s CEO, said, “We want to leverage the extensive expertise and relationships that the Multiples team has in the Indian financial services space.”

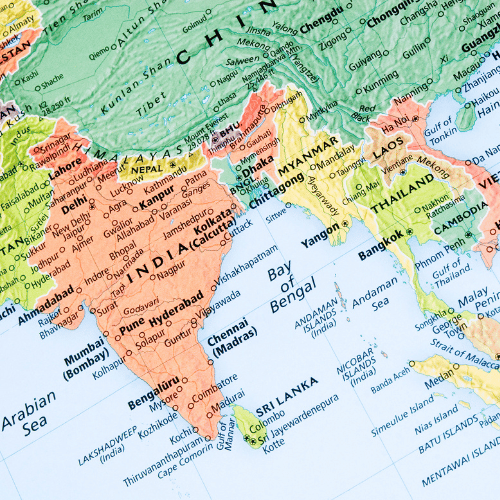

Over 10,000 new users join Niyo’s platform daily, and the company serves almost 4 million consumers with its banking and wealth management products. It is India’s largest consumer neo-banking platform, processing transactions totaling over $3 billion.

It stated in a statement that “the funds will also be used for brand building and enhancing team strength across functions.”

Niyo, a company founded in 2015 by Vinay Bagri and Virender Bisht, collaborates with banks to provide digital savings accounts and other financial services.

It’s amazing that Niyo is able to reach customers in 16,000+ pin codes which cover 80% of the pin codes in India,” said Nithya Easwaran, managing director at Multiples PE.

“India has 750 million smartphone users which are expected to grow to 1 billion over the next 3-4 years. Fintech platforms in symbiotic collaboration with traditional financial institutions can construct and deliver embedded sachet products digitally in a highly cost-effective manner thereby driving financial inclusion,” she added.

Niyo is looking to develop its product suite to have more consumer-focused products like credit cards, remittances, loans etc.

“Our foray into new product categories will help us leverage the massive tailwinds for digital financial products the market is seeing today,” said Bisht, its chief technology officer, Niyo.

Avendus Capital was the exclusive financial advisor on the transaction.