Carmen Vicelich, founder and CEO of Valocity shared that the company was delighted to welcome Mandal’s caliber who has years of expertise in the category and will participate in building and delivering transformational solutions.

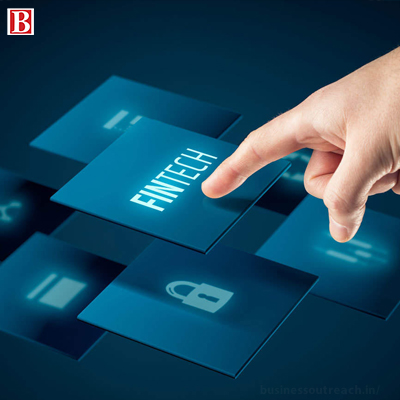

Mortgage lending fintech startup Valocity announced on October 5, 2021, the positioning of Sovan Mandal, the former Chief Business Officer of IMGC (India Mortgage Guarantee Corporation) as the CEO (Chief Executive Officer) of the company for managing its operations in India.

Mandal holds more than 20 years of experience serving in the financial sector in India as well as abroad. Valocity disclosed in a statement that the former chief business officer as well as one of the founders of IMGC, Mandal contributed substantially in introducing and developing mortgage guarantee as an all-new service in India.

Carmen Vicelich, founder and CEO of Valocity shared that the company was delighted to welcome Mandal’s caliber who has years of expertise in the category and will participate in building and delivering transformational solutions and innovative ideas helping to elevate property space in India.

Mandal stepped forward expressing his enthusiasm to join hands with Valocity innovative team. He said, “I’m excited to join the innovative team at Valocity India and look forward to my role leading this transformation of the industry.”

He further portrayed the startup’s potential saying that he was confident that Valocity would produce value-based products and services by accessing enhanced technology, data, and analytics.

What is Valocity about?

Based in New Zealand, Valocity is a digital mortgage lending and end-to-end valuation ordering platform which delivers digitization, automation and futuristic solutions and ideas for the property valuation space. It operates in dual partnership of banking as well as valuation communities. The fintech startup claims to harness technology and data to provide digital transformation which aims at serving noteworthy organizational value.

How does Valocity work?

Valocity fintech operates by discharging its solution and valuation-based functions serving mainly two communities- the banking and valuation. Let us look at how the company operates:

For Banking community

- Valocity helps in giving transformational solutions for the mortgage and valuation process with the new generation enhanced technology, data as well as analytics.

- Making the platform operate digitally, it automates workflow which brings efficiency and elevates the scale of operations.

- It assists its customers in cutting down the costs on infrastructure, training, etc.

- Valocity effortlessly adapts with bank credit measures and its workflow.

- Updates with property valuation and authentication.

For Valuation Community

- Valocity provides end-to-end uncomplicated digital solutions based on valuations to property valuation in the country.

- It offers a safe and secured platform which lets its users get in touch with lenders digitally for seamless experience, additionally providing data and documents storage services.

- Helps its users organize and customize their workflow through a mobile application which has tools including remote, digital security, etc.

Valocity operates in 4 countries including New Zealand, Australia, Singapore, and India. The Fintech Corporation has its offices established in Indian cities namely- Delhi and Mumbai. It was recognized as 2020 Microsoft Partner of the Year for providing creative services based on Microsoft-backed technologies which stand out impeccably in the property space.