Ravi, a young professional from Mumbai, needed quick cash to cover unexpected medical expenses. Desperate and with no other options, he took out a personal loan from a lender promising quick approval. The interest rate seemed high, but he didn’t realize just how much it would impact him. Within months, Ravi found himself struggling to keep up with the exorbitant interest payments, hidden fees, and relentless harassment from debt collectors. His experience is not unique; countless Indians face similar financial hardships due to bad loans.

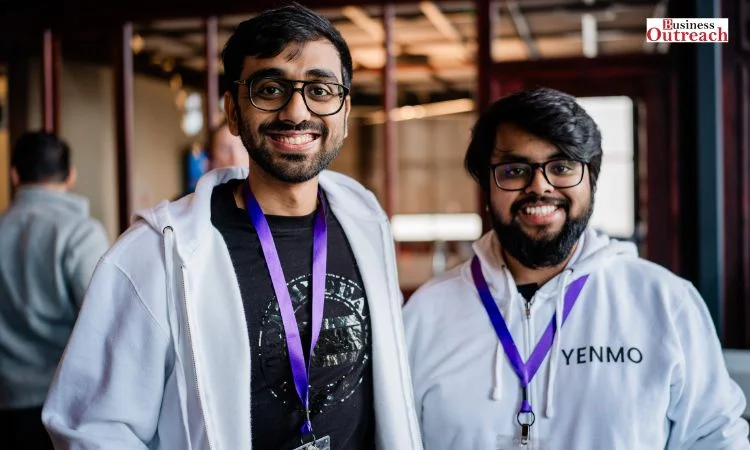

Observing stories like Ravi’s – Ashutosh and Aryan, the founders of Yenmo who come from Gujarati and Marwadi backgrounds, respectively, became acutely aware of how many people were getting trapped in debt cycles. Coming from communities where loans are vital tools in the business world, they had witnessed firsthand the positive role that loans play in enabling growth, innovation, and financial stability.

Businessmen in their communities regularly used loans to expand their enterprises, secure with the knowledge that the terms were fair and transparent. This contrast between the positive experiences of business loans and the negative experiences of personal loans led to a critical realization: there are good loans and bad loans, and there is a lack of companies offering good loans to the average consumer.

Bad loans, like the one Ravi encountered, are characterized by several detrimental features. These loans often come with interest rates upwards of 18%, making it difficult for borrowers to keep up with payments. Many lenders tack on hidden fees that aren’t initially disclosed, further increasing the borrower’s debt burden. On top of this, harassment and pressure from collectors add stress to an already difficult financial situation.

In stark contrast, good loans prioritize the borrower’s financial well-being. Affordable rates, such as Yenmo’s 10.5% per annum, ensure that borrowers can manage their repayments without undue strain. All charges and fees are clearly disclosed upfront, so there are no unpleasant surprises. Good lenders respect their customers, offering flexible repayment options and avoiding aggressive recovery tactics.

Yenmo is dedicated to changing the negative perception around loans in India. Their mission is to provide financial solutions that are affordable, customer-friendly, and transparent. With a low-interest rate of 10.5%, they make borrowing more manageable. They also offer flexible repayment options, allowing you to pay only the interest every month and the principal whenever it suits you, without any part payment or foreclosure fees. All their charges are clearly communicated upfront, ensuring you are fully informed and in control.

Yenmo believes that loans should be a tool for financial empowerment, not a trap. By offering fair, transparent, and customer-centric loan products, Yenmo aims to foster a more positive and responsible borrowing culture in India. They are committed to providing financial solutions that support your goals and help you achieve a secure and prosperous future.

Choose Yenmo, and experience the difference of a good loan—a loan that works for you.