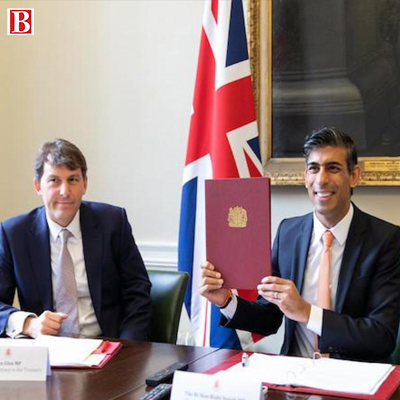

India and UK signed a $ 1.2 billion agreement on September 2, 2021, regarding the investments in green projects and renewable energy calling attention to India’s uncompromising green growth. The agreement took place virtually between our Finance Minister, Nirmala Sitharaman, and her British counterpart Sunak at the 11th India-UK Economic and Financial Dialogue.

“ The UK and India already have strong ties, and today we’ve made important new agreements to boost our relationship and deliver for both our countries,” quoted Sunak.

This virtual agreement of Sitharaman and Sunak contributing to India’s ‘green growth’ lists down the public and private investments in green projects and renewable energy in India. A few of the highlights of the agreement are listed below:

⦁ Investment from UK’s development finance institution, CDC, in the green project;

⦁ Joint investments by both the governments to empower the companies serving innovative green tech solutions;

⦁ For the Indian renewable energy, a new USD 200 million private and multilateral investment into the joint Green Growth Equity Fund.

In the view of devoting to the sustainable infrastructure of the country, for instance, wind and solar energy as clean energy, and other green technologies, a new Climate Finance Leadership Initiative (CFLI) has also been agreed on to mobilize and utilize private capital into these segments. Sunak shared, “ Supporting India’s green growth is a shared priority so I’m pleased that we’ve announced a USD 1.2 billion package, and launched the new CFLI India partnership, to boost investment in sustainable projects in India as the UK gears up to host COP26.”

Spotlighting the importance of upcoming trade negotiations between the governments, Sitharaman and Sunak expressed ambitious enthusiasm regarding forthcoming opportunities for collaborations in both markets. The market will doubtlessly support jobs and investments will to ultimately contribute towards financial growth. In his exact words, Sunak said, “With our trade negotiations also becoming up, our agreement to be ambitious when considering services will create new opportunities in both markets, supporting jobs and investments in the UK and India.”

As India’s contribution to the British government, it took a step forward in lifting the Foreign Direct Investment (FDI) cap in the insurance sector from over 49 percent to 74 percent. This will augment the British ownership of their operations in India.

Future plans of India & UK

Both the countries have jointly agreed to set a goal of doubling trade by 2030 by the means of Free Trade Agreement( FTA) followed by Enhanced Trade Partnership(ETP), agreed between our honorable Prime Minister, Narendra Modi, and his UK counterpart, Boris Johnson earlier this year in 2021.

Economic Financial Dialogue stated in the progress of the India-UK strategic partnership on Gujarat International Financial Tec-city (GIFT), which promotes the links between GIFT city and the UK financial marketplace. The EFD statement notes, “ Both the countries welcome that UK banks are the first international banks to set up in the GIFT City, underlining the strength of UK-India cooperation. Both sides agree to explore facilitating the dual listing of green, social and sustainable bonds on the London Stock Exchange(LSE) and IFSC exchanges, to enable firms to raise foreign capital.” This international agreement is expected to be resulting in the financial and overall growth of the country”

.