Reliance Jio, one of India’s telecommunications providers is preparing to unveil a device called Jio AirFiber that is specifically designed for consumers. Anticipated to be launched during the season this device may provide customers with a discount of, up to 20% when compared to alternatives. This move represents a milestone, for Jio as it aims to capitalize on the potential of 5G technology following its introduction of data top-up packages earlier this year.

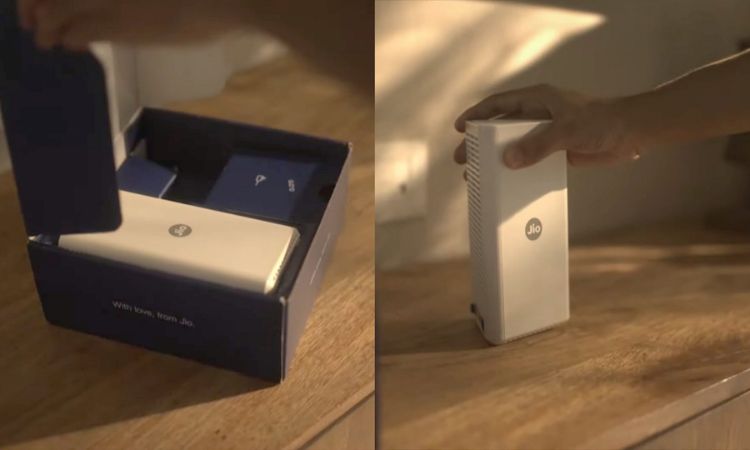

Reliance Jio, the dominant player in India’s telecom market, is reportedly gearing up to unveil its consumer-focused fixed wireless access (FWA) device named Jio AirFiber. This move is expected to take place during the festive quarter, with sources suggesting that the device might be offered at a discount of up to 20% compared to existing market options.

This strategic move marks Jio’s first substantial foray into monetizing 5G technology, following the introduction of its data top pack earlier this year.

Insiders anticipate that the official announcement will coincide with the upcoming Annual General Meeting (AGM). Jio has a tradition of launching new products with attractive offers, and this situation is unlikely to deviate from that norm, according to an undisclosed source.

The telecom giant has reportedly initiated consumer trials in cities where its 5G network has been successfully deployed and stabilized. Additionally, selected users, including employees, have received devices for in-home testing, which serves as preparation for the device’s imminent launch.

Jio’s FWA device will leverage carrier aggregation technology, which facilitates data transmission through various 5G airwaves. These airwaves, including the 700 MHz, 3300 MHz, and 26GHz frequencies, were secured by the telco in the previous year’s spectrum auction.

In a recent development, Jio’s competitor, Bharti Airtel, introduced its own FWA offering, labeled Xstream AirFiber, in Mumbai and Delhi. Priced at Rs 2500, the subscription costs Rs 799 per month. Airtel’s subscription is available in six-month blocks, which brings the initial investment close to Rs 7300.

Given this existing competition, industry analysts anticipate that Jio might employ competitive pricing tactics, such as discounted devices or even a trial period, to challenge Airtel’s six-month commitment structure.

Earlier this month, Jio unveiled an FWA device catering to enterprise connectivity, utilizing the 26 GHz frequency band acquired during the 2022 5G spectrum auction.

Notably, Jio has been discussing its FWA offering for retail consumers for nearly a year now, first revealing plans during its parent company Reliance Industries Limited’s (RIL) AGM in the previous August. Subsequently, the device was showcased at industry events, and the company’s management has consistently hinted at its impending launch during earnings calls.

During the most recent earnings call, Kiran Thomas, President of RIL, highlighted that the FWA offering is poised to make a significant contribution to Jio’s home broadband business, potentially connecting up to 100 million premises.

On a global scale, Swedish telecom infrastructure provider Ericsson reported 100 million FWA connections in 2022, with projections indicating a rise to 300 million by the end of 2028, with 80% of these connections leveraging 5G technology. Given India’s high data consumption and vast geographical landscape, multiple reports identify India as a pivotal market for driving FWA adoption.