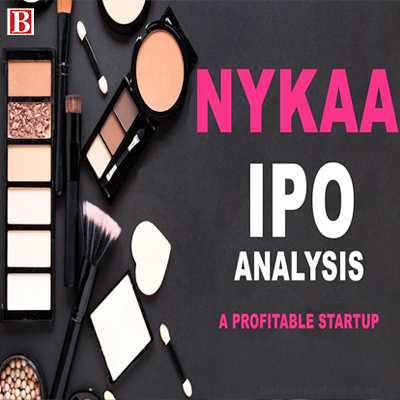

Nykaa had earlier filed its DRHP (Draft Red Herring Prospectus) with SEBI on August 2, 2021. The planned IPO size was calculated to be Rs. 4,000 crore.

Securities and commodities regulator, SEBI (Securities and Exchange Board of India) has given green signal for Rs. 4,000 crore worth IPO (Initial Public Offering) of e-commerce establishment Nykaa which sells beauty and fashion-based products in its platform.

It is reported that Falguni Nayar- founded establishment is eyeing to launch its first public offering by the end of October, 2021, at valuations more than Rs. 45, 000 crore.

Nykaa had earlier filed its DRHP (Draft Red Herring Prospectus) with SEBI on August 2, 2021. The planned IPO size was calculated to be Rs. 4,000 crore, out of which the company decided to raise Rs. 525 crore through fresh equity issue. Nykaa is also intending to sell secondary shares (besides equity shares) which will account for about 43.1 million shares.

The company’s Rs. 4,000 crore raised from the IPO is expected to be utilized in paying existing investors who will be selling their stakes. The selling shareholders include Sanjay Nayar, Sunil Munjal and private equity firms like TPG, Lighthouse, etc.

Nykaa will use the proceeds of the IPO to elevate its brand exposure in the market and more visibility. It will also use the proceeds to repay the company’s debt. Reportedly, the e-commerce company is additionally sketching out plans to work and expand its offline presence in the marketplace, and for this, the company is all geared up to invest about Rs. 35 crore in establishing new offline stores.

Jefferies, a broking firm mentioned in a recent note that Nykaa has witnessed growth. The note stated that the online space and opportunity in India is luring various differentiated players from numerous categories and growth observed in most of the cases is at the cost of the company’s profitability. Nykaa’s product assortment and the content ecosystem are quite engaging as mentioned in the note.

Nykaa is the only profitable unicorn which is going to go public very soon. Where most of the startups have a long way to turn profitable, Nykaa had hit revenues of Rs. 2,440 crore, reporting a bottomline of Rs. 62 crore in financial year 2021. It had reported bulk revenue of Rs. 1,860 crore in FY20 which crowns it as the only profit-making company which is going public.

Founded in 2012, Nykaa was established by Falguni Nayar who has worked earlier as a Managing Director at Kotak Mahindra Capital Company. She together with her husband Sanjay Nayar holds a 54 per cent stake in the e-commerce company.

Nykaa sells from over 1,500 brands included in its portfolio. The company also has in-house brands in the beauty and fashion segment including Nykaa Naturals, Nykaa Cosmetics, Kay Beauty, 20 Dresses which it acquired in 2019, Nykd by Nykaa, Likha, RSVP, Pipa Bella, etc. Besides beauty and fashion, Nykaa has also established its presence in the entertainment space. The company hosts its beauty and fashion content via Nykaa TV, its YouTube channel. It delivers informational content related to beauty and fashion.