Vision Fund reported a substantial loss of $32 billion in May. However, Son’s primary focus remains on the AI revolution, which he believes will surpass human capabilities. SoftBank aims to establish a leading position in this transformative era. Following Son’s remarks, SoftBank shares surged by 2.63% in Wednesday’s morning trade.

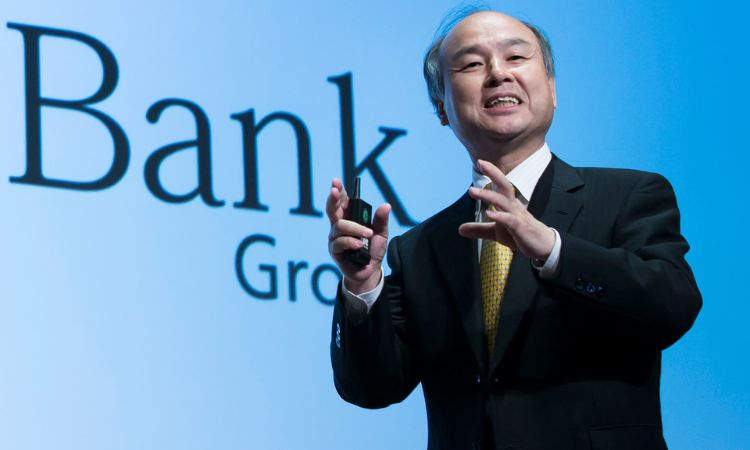

Image-: CNBC

SoftBank Group’s chairman and CEO, Masayoshi Son, made an intriguing announcement during the company’s annual general meeting. He declared that SoftBank is transitioning from a defensive stance to an offensive strategy, aiming to seize opportunities in the AI revolution. Son expressed his enthusiasm for this shift, highlighting the significant growth of their cash reserves, now amounting to five trillion yen ($35.3 billion).

SoftBank, a renowned tech conglomerate engaged in venture capital investments through its Vision Fund, has experienced both successes and setbacks. During the defensive phase, they temporarily halted new investments and reduced their stake in Alibaba. Unfortunately, the Vision Fund reported a substantial loss of $32 billion in May. However, Son’s primary focus remains on the AI revolution, which he believes will surpass human capabilities. SoftBank aims to establish a leading position in this transformative era.

Following Son’s remarks, SoftBank shares surged by 2.63% in Wednesday’s morning trade. The Vision Fund, having invested in Chinese tech companies, faced challenges due to Beijing’s crackdown on the sector, leading to a decline in share prices. Notable portfolio companies of SoftBank include ByteDance, DiDi Grocery, and Coupang. Moreover, SoftBank is preparing for the IPO of Arm, the UK-based chip design firm they acquired in 2016. Arm has filed for listing in the US, and the IPO (Initial Public Offering) process is progressing smoothly according to SoftBank’s CFO, Yoshimitsu Goto.

Recent months have witnessed explosive growth in artificial intelligence, largely driven by the virality of the chatbot ChatGPT. Researchers and the general public have been astounded by ChatGPT’s ability to generate human-like responses. Son, being a heavy user of ChatGPT himself, expressed his amazement at its capabilities. As a result, the prospects for SoftBank are expected to improve significantly, as highlighted by Amir Anvarzadeh, a strategist in Japan’s equity market.

Anvarzadeh further emphasized the significance of Nvidia’s previous interest in acquiring Arm, as it sought to secure exclusive access to its architecture. Although Nvidia withdrew from the $40 billion deal, Anvarzadeh speculated that Arm’s value could be worth $30 billion or even $60 billion in the present context. This realization aligns with SoftBank’s upcoming IPO plans for Arm, indicating the potential for substantial gains.

Ayush Singh.