SoftBank, yeah, you’ve probably heard of them! They’re based in Tokyo and they’re all about investing and managing investments. But they’re not just into any old companies. They go for the tech sector. They invest in companies that do all kinds of things, from internet stuff to automation. They’re like the big shots when it comes to finding promising businesses in different markets and industries.

From Tokyo to the Tech World: The SoftBank Story

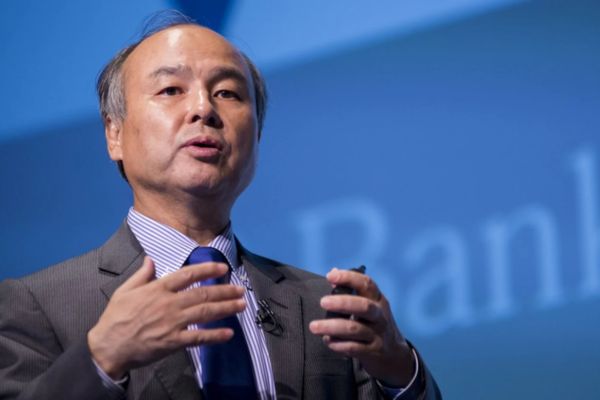

Masayoshi Son is a big-shot in the tech and investment world. He’s the founder, chairman, and CEO of SoftBank, a Japanese holding corporation. He’s also the Chairman of Arm Holdings and the CEO of SoftBank Mobile. This man has made a ton of money and is considered one of the wealthiest people out there.

But here’s the thing, he didn’t always have it easy. Back in the dot-com crash of 2000, he actually suffered the biggest financial loss ever recorded, around $70 billion. Ouch! But he didn’t let that bring down his morale. As of September 2022, he’s still ranked 73rd on Forbes’ list of the world’s billionaires.

Now, let’s rewind a bit to his early life. Masayoshi Son was born into a Korean family living in Japan. He was a smart and curious kid, always fascinated by America. When he was just 16, he went on a study abroad program to the US and fell in love with the place. So much so that he decided to ditch school in Japan and spend more time in the US. He ended up enrolling at Holy Names University and later transferred to the University of California, where he studied computer science and economics.

During his time in college, Son realised that microchips and computer technology were going to be huge game-changers in the business world. He started coming up with business ideas every day, and by the end of the year, he had 250 ideas. Some of these ideas turned out to be incredibly successful and made him filthy rich.

After graduating in 1980, he founded a company called Unison in California, which was eventually acquired by Kyocera. But Son didn’t stop there. In 1981, he established SoftBank in Japan with just two part-time employees and a small office. Initially, SoftBank sold software packages to Japanese customers, but it quickly expanded into other ventures.

SoftBank: The Tech Investment Titans

SoftBank is well-known for its large investments and has made significant acquisitions over the years. One of its notable investments was in Alibaba, a Chinese e-commerce company, which turned out to be highly successful when Alibaba went public. SoftBank’s Vision Fund, with over $100 billion in capital, is the world’s largest technology-focused venture capital fund.

The company also has subsidiaries and divisions, including SoftBank Corporation, which is the third-largest wireless carrier in Japan. SoftBank bought stakes in various internationally recognized companies, such as Arm (semiconductors), Alibaba (e-commerce), OYO Rooms (hospitality), WeWork (coworking), and Deutsche Telekom (telecommunications).

SoftBank’s Strategy for Success

SoftBank’s business model is like being the ultimate tech investor. They’re all about hunting down those awesome tech companies that they think will hit it big and making bank from their investments.

Think of SoftBank as this giant company that loves to buy shares in all sorts of tech companies. When SoftBank spots a tech startup with serious potential, they jump right in and invest a boatload of money. Sometimes they even go all in and buy a big chunk of the company, so they can have some say in how things are done. It’s like becoming a part owner of the next big revolution.

But they don’t stop there. SoftBank is not just about waving their money around and hoping for the best. They provide these companies with advice, support, and connections to help them grow.

SoftBank has a massive fund called the SoftBank Vision Fund. This fund raises huge amounts of cash from other folks who also want in on the tech action. Then, SoftBank uses all that money to make mega investments in tech companies from all over the world. They play the game on a global scale.

The whole point of SoftBank’s game is to make stacks of cash by investing in the right companies at the right time. They’re always on the prowl, looking for the next big tech sensation. They want to be right there at the front of the pack, riding the wave of all the awesome innovations.

So that’s SoftBank’s business model in a nutshell. It’s about making mad money and being a major player in the world of tech. The company’s business model revolves around identifying transformative technology companies, driving their growth, and positioning itself as a key player in the ever-evolving technology landscape.

What’s currently happening? SoftBank’s Vision Fund and the $32 Billion Loss

SoftBank’s Vision Fund just reported a mind-boggling loss of $32 billion for the fiscal year 2023. This huge drop in value has sent shockwaves through the investment community, and people are questioning the fund’s investment strategy and overall performance. So, let’s dig into what led to this record loss and what it means for SoftBank and its investment portfolio, as well as the future of the fund.

The Vision Fund’s performance was greatly affected by the volatile market conditions and economic uncertainty that prevailed in fiscal year 2023. The COVID-19 pandemic, geopolitical tensions, and concerns about global economic growth all contributed to market fluctuations, which had an impact on the valuation of the fund’s portfolio companies. Some of the high-profile technology companies that the Vision Fund invested in faced significant challenges during the fiscal year.

WeWork, a shared workspace provider, had a highly publicised failed initial public offering (IPO) attempt, resulting in a substantial write-down of the fund’s investment. Other investing businesses, such as Oyo and Uber, experienced operational and financial issues, affecting the fund’s performance as a whole. The fund heavily relies on fair value accounting, where the valuations of private companies are estimated based on a set of assumptions and market conditions. The fund had to evaluate the values of numerous portfolio firms during fiscal year 2023, resulting in negative revisions owing to fluctuations in market circumstances and financial performance.

So, what are the implications for SoftBank and its investment strategy? The Vision Fund’s big loss, on the other hand, has clear financial ramifications for the group’s parent company. The loss affects the overall profitability of the group and its ability to generate returns for its stakeholders. SoftBank Group’s stock fell after the news as confidence among investors waned. This huge loss necessitates a thorough examination of SoftBank’s investment approach and management of portfolios. The Vision Fund’s focus on making major investments in technology startups has inherent risks, as the profitability of these firms is frequently linked to market trends and external variables.

SoftBank may consider broadening its investment profile by investigating industries with more consistent returns and picking investment possibilities with greater caution. The significant loss in the Vision Fund could also impact SoftBank’s reputation as a powerhouse in the investment world. The shareholders and prospective alliances may be wary of SoftBank, making it difficult for the business to secure capital for potential investment vehicles.

SoftBank will need to rebuild trust, show resilience, and demonstrate its ability to deliver substantial returns in order to attract investors for future ventures.

Internal reasons cannot be blamed for the Vision Fund’s historic loss. External issues such as regulatory hurdles and geopolitical conflicts were also important. Trade tensions between the United States and China, for example, impacted the performance of several portfolio companies with exposure to these markets. Additionally, regulatory crackdowns on industries like ride-hailing and shared accommodation affected the profitability and valuation of related investments. SoftBank will have to overcome these external obstacles while also adapting its investing approach. The corporation must address these concerns by improving communication, demonstrating a commitment to sound governance practices, and incorporating the lessons learned from this downturn into its investment decision-making processes.

Unravelling SoftBank’s Record Loss: Implications and Strategies for the Future

Looking ahead, SoftBank and the Vision Fund have several steps to take in order to recover from the significant loss and strengthen their position in the investment landscape.

One key aspect will be portfolio restructuring and a focus on profitability. SoftBank needs to carefully assess its portfolio and make strategic decisions to divest underperforming assets(for example what the corporation is doing with Alibaba’s shares). By providing strategic support to struggling portfolio companies, it can help them improve their financial performance and ultimately enhance returns. Additionally, actively monitoring the financial health and market viability of its investments will be crucial to avoid future losses.

In terms of investment focus, SoftBank is likely to reevaluate its strategy and consider shifting its attention to sectors that offer more predictable revenue streams and growth potential. This could involve exploring areas like healthcare, real estate, renewable energy, or established technology companies with a proven track record. Diversifying the investment portfolio will help reduce exposure to high-risk ventures and seek more stable returns.

To prevent similar losses in the future, SoftBank must strengthen its risk management practices. This includes conducting thorough due diligence on potential investments, closely monitoring the performance and financial health of portfolio companies, and implementing stricter risk controls. Having a clear exit strategy for underperforming investments will also be essential in mitigating future losses.

SoftBank will also need to regain investor confidence and rebuild trust. Enhancing communication with stakeholders, demonstrating a commitment to sound governance practices, and providing greater transparency and accountability in future investments will be crucial steps in this process.

While the recent loss is undoubtedly significant, the Vision Fund still holds a diverse portfolio of companies with growth potential. By actively supporting and nurturing these investments, SoftBank has an opportunity to unlock their value and potentially recover from the setback. Strategic decision-making, operational improvements, and a focus on sustainable growth rather than short-term gains will be essential in this recovery process.

SoftBank’s experience will very certainly have larger consequences for the investing environment, particularly in the technology sector. Investors and industry participants may reconsider their risk tolerance and take a more cautious approach when evaluating new investments. This shift in sentiment could impact valuations, funding availability, and overall market dynamics. SoftBank’s journey can serve as a valuable case study, prompting a reevaluation of investment strategies and risk management practices across the industry.

Well, there you have it—the roller coaster ride of SoftBank and its Vision Fund. From the ambitious founder, Masayoshi Son, to the company’s massive investments in the tech world, SoftBank has made quite a name for itself. But even giants stumble, as evidenced by the recent record loss of $32 billion for the Vision Fund.

SoftBank’s recovery journey will be closely watched, not just by its stakeholders but also by the entire investment landscape. The technology sector, in particular, may see a shift in risk appetite and a more cautious approach to investments. SoftBank’s experience serves as a valuable case study for the industry, prompting a reevaluation of strategies and risk management practices.

In the end, SoftBank’s story is a testament to the highs and lows of the investment world. It’s a reminder that even the most successful companies face setbacks, but it’s how they respond and adapt that determines their future success. SoftBank’s future will be defined by its ability to learn from its mistakes, make prudent decisions, and regain its position as a major player in the ever-evolving tech landscape.