The government created Post Office plans to encourage long-term savings and to make some of them more appealing to investors. India Post offers a wide range of quick-to-open, effective, and secure investment options.

You can choose the approach that most closely resembles your investment objectives. Also, in accordance with Section 80C of the Income Tax Act of 1961, these programs offer tax benefits. Certain tax-advantaged programs are provided by the post office, including NSC, SCSS, SSY, and PPF.

A public provident fund

A public provident fund, which enables its user to accumulate a sum of money large enough to be paid at maturity along with interest, is an example of a financial product. Currently, the PPF offers a 7.1% yearly compound interest rate. Contributions made to the PPF program up to a maximum of Rs. 1.5 lakhs, interest received on such deposits, and maturity monies are all exempt from tax under Section 80C of the IT Act. The PPF scheme thus offers a triple tax benefit.

Sukanya Samriddhi Yojana

A Sukanya Samriddhi Yojana account may be opened in the name of a girl child under the age of ten. The daughter will take ownership of the account once she is 18 years old. When a girl gives birth, more accounts could be created for twins, triplets, or more. The interest rate for this plan right now is 7.6%. A minimum initial contribution of Rs 250 and a maximum of Rs 1,50,000 each fiscal year are required by the scheme. This plan offers tax exemption under Section 80C of the Income Tax Act of 1961 in addition to financial savings.

Senior Citizen Saving Schemes

Anybody 60 years of age or older may invest in this plan. As long as they invest within a month of receiving retirement funds, this plan is open to seniors over 55 but under 60. The minimum and maximum investments are fixed at Rs. 1 and Rs. 15 lacks, respectively. Its original five-year term is increased by an additional three years as it matures. The Senior Citizen Savings Plan offers an interest rate of 8% annually for deposits made throughout the quarter of January through December. Each quarter, the interest is due and completely taxable. There is no interest offered as the plant ages. When the investment is made, the interest rate also doesn’t change.

Seniors can deduct their investments in this plan from their taxes under Section 80C of the Income Tax Act of 1961.

Post Office Time Deposit Account

The National Savings Time Deposit Account provided by India Post is another name for the Post Office Time Deposit. They offer a variety of tenures and are relatively equivalent to bank fixed deposits. Every three months, interest rates for small savings plans like Post Office time deposits are altered. The minimum investment is Rs 1,000, and there is no maximum. The account holder’s savings account will be rewarded with yearly interest.

Section 80C of the Income Tax Act of 1961 applies to the investment made under the 5-year TD. The interest rate for a 5-year term deposit is 7% this quarter.

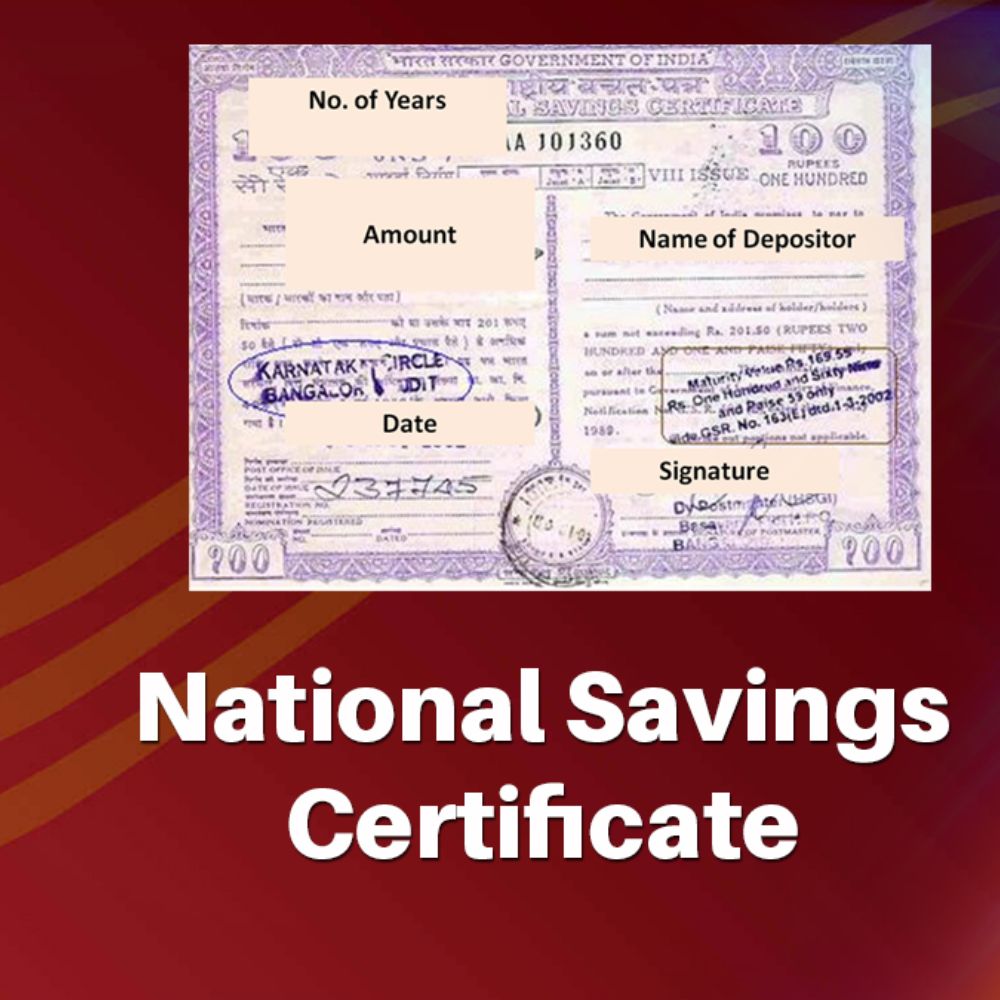

National Saving Certificate (NSC)

Multiples of 100 rupees should be invested for a minimum of 1,000 rupees. There is no upper limit. After five years from the contribution date, the account will expire. An NSC investor can also obtain loan funding if they can convince a bank to guarantee their investment. For instance, the National Savings System offers a 7% percent guaranteed return on NSCs. The annual fixed interest that the NSC routinely offers ensures a steady income for the client. The deposit is deductible under section 80C of the Income Tax Act of 1961.