Over the last few years India have seen immense growth and increase in the UPI transactions, With launching of the number of UPI apps and easy and instant mode of payment the UPI payment are on the top of the mode of transactions.

Before understanding about the impact of UPI on the Fintech industry, let us first take a deep insight about UPI.

Table Of Contents

- UPI

- Impact of UPI on Fintech Industry

- Future of UPI

- Change of Trend

- Innovation in the Fintech Industry

- How to create UPI ID

Conclusion

UPI

UPI stands for Unified Payment Interface which was developed by National Payment Corporation of India as a real time payment system. It was launched in 2016, by the RBI under the governor Raghuram Rajan. UPI allows the user to link multiple bank accounts for the payment through UPI and enables easy, faster and safe fund transfers.

In India the stats of the number of UPI transactions have been growing each day. Almost every retailer, vendor, and even the personal family transactions are done through UPI. It has become a lifeline for online payment majorly in India as Indians have been using UPI even for small amounts of transactions.

Impact of UPI on Fintech Industry

FIntech industry refers to the sector where companies involved integrate the technology with financial services to improve the financial service use and delivery to the users. It stands for financial technology, adding tech into finance.

UPI has had a significant impact on the fintech industry and companies.

Introduction of UPI has increased digital payment in the last few years at very massive rates. Previously people were depending more on cash and prefer less digital payment options but with UPI every small transaction is completed with UPI payment.

Faster and hassle free payment

UPI has made the payment through online mode easier. Earlier before UPI the online payment was considered a bit tough task for majority of the Indians. In the country of majorly small retailers, groceries and shopkeepers understand digital payment and internet banking is a complex task. UPI has eliminated all these obstacles with an easier online mode to transfer money in a few clicks in a hassle free manner.

Users can create a UPI id easily on any of the bank applications or other online payment platforms and set the pin to make the payment through UPI.

Easy Online Shopping

With UPI online shopping through an E-commerce platform can be done in a better manner. Earlier selecting the online payment mode, adding card details, verifying OTP and ensuring successful payment was a time consuming and complex process. Though UPI payment can be done directly from a bank account to the vendor in just a few clicks and helps to settle the transaction in a real time. This also encouraged more people to choose online payment options on a payment gateway over COD (Cash On Delivery).

Reduced Transaction Cost

UPI has reduced the cost of making payment through online mode. Previously for any online transaction a fixed charge based on the amount is deducted by banks and financial institutions to honour the transactions, but UPI has eliminated and reduced such transaction cost.

Cost involved in credit card swipe, RTGS can be reduced with the use of UPI.

More Market Participant

WIth the increase in the number of users of online payment mode, more companies are entering into the Fintech market. This increased the competition among the fintech companies as recently many startups have been launched in the industry offering many latest tech-ad financial services in the market. Though the competition rises in the market it leads to the launch of more innovative products and services which makes the industry more dynamic and innovative. Every bank offers their own UPI services in the market apart from the top UPI players.

Enhance users trust

UPI has gained the trust of the users on the online payment. In India majorly people consider online payment to involve a lot of risk and chance of fraudulent activity. With UPI, customers have found online payment safe and secure from financial fraud and risk. Though it includes risk of fraud but it has been eliminated to a great extent.

It offers two modes: person to person (P2P) and person to merchant (P2M).

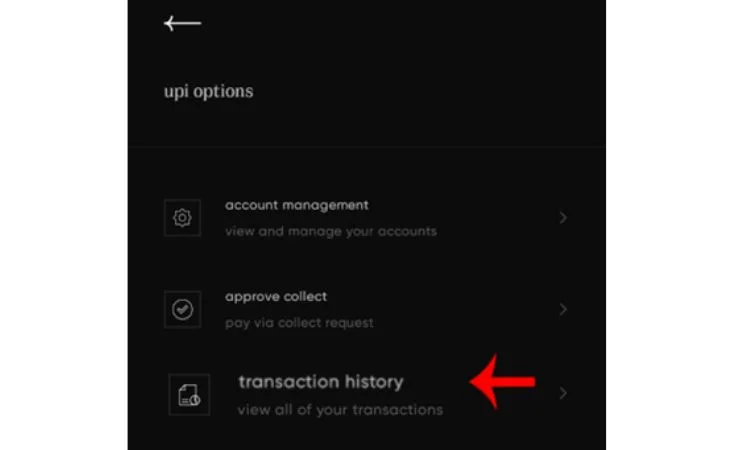

Record of transaction history

Transaction history of the receipt and payment can be easily checked from the history. It will show all the transactions of the said period including both receipt and payment from the account.

Change of Trend

The trend from cash or hard note transactions have changed to digital payment transactions. Before the launch of UPI payment Indian business, personal and all other transactions are settled in the cash mode. Very minor number of transactions were completed through the digital mode looking at the complexity and time consumed in the online transactions. Further also UPI has won the trust of the people for the online transactions security and safety. This was also another reason for such a significant change in the trend from cash payment to online digital transactions. Today, even for the small shopping and day to day expenses Indians use UPI. The reliance on the cash has been reduced to a significant percentage, more people now deposit their cash to the bank accounts which also help banks and the financial system to run the cycle well.

UPI is not only used for the payment of the business transaction but for various purposes. For online shopping, online tickets (movies, train, bus, travel), bill payment, food order, online booking, shopping, ride and for many other purposes. Even for the auto rickshaw and cab ride Indians are using the UPI payment mode. From a cup of tea a Nukkad to a business transaction UPI has taken the place of the cash settlement almost to a great extent.

Future of UPI

Currently UPI can be used on a smartphone only. Through smart phones using the bank or payment platform application users can make the payment. THe number of users of UPI has been increasing looking at the convenience of the payment mode.

But, recently NPCI has launched UPI 123Pay.

This new avatar of UPI will eliminate the issue of UPI on only smartphones. Non smartphone users will be able to easily make the payment using UPI without internet and application.

The UPI Pay123 is just a call and payment process. Users will cal on the number of the merchant’s end, after that entering the amount and UPI Pin, users will receive a call back and then the payment will complete.

Global UPI

Currently UPI is mainly used in India and for the payment in the domestic region. But soon the mode of payment will be accepted worldwide and funds can be transferred from one country to another using UPI. Recently NIPL (NPCI International Payment Limited) has entered into an agreement with Liquid group (Singapore) to enable UPI based payment in ten nations of the world.

Innovation in the Fintech Industry

UPI is bringing various developments and innovations in the Fintech Industry. Looking at the positive outlook and demand in the industry, more startups are joining the way of Fintech companies. With these more incredible ideas, concepts, solutions are brought into the market by the market players for the users.

How to Create UPI ID

- At first users needs to open the desired platform where he wish to start the UPI (Paytm, Phonepe, Googlepay or any other app)

- After downloading the app, verify your mobile number to registered with the UPI app

- After Registering select your preferred bank to connect with your UPI payment.

- Add the bank details to link your bank account with UPI id.

- Once the bank account gets linked, set your UPI Pin which will be used to authorise your UPI transactions.

Conclusion

UPI payment has crossed more than 300 million monthly active users in India as in Nov 2022. Number of transactions per second through UPI have increased in a significant manner since inception. Today around 492 banks live on UPI and in Sep 2023, more than 15 lakh crore rupee worth of transactions were made through UPI. As of Sep 2023, Phonepe, Google Pay, Paytm payment bank are the top UPI apps in India based on the number of transactions.

India has revolutionised online payment with the introduction of UPI.

In the long run, the UPI will be a globally accepted digital mode of payment for fund transfer. Further with the introduction of innovative technology and fintech startups many significant changes can be seen in the Unified Payment Interface to make the users experience more better and easier.